NASSAU, Bahamas – Bahamas Prime Minister Phillip Davis says last year the country experienced a robust economic rebound, primarily fueled by significant tourism inflows, leading to an estimated real gross domestic product (GDP) growth of 4.3 per cent.

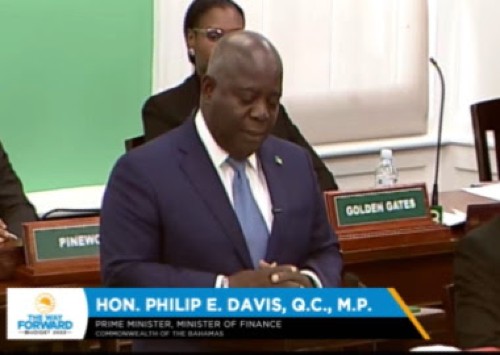

“This growth, while lower than the previous year’s remarkable 14.4 per cent, produced an unemployment rate below nine per cent. Inflation peaked in mid-2022. The current account deficit also narrowed to 6.2 per cent of GDP, showcasing a positive trend in external balances,” Prime Minister Davis said in his mid-year review of fiscal performance for the fiscal year 2023/24,

“This growth, while lower than the previous year’s remarkable 14.4 per cent, produced an unemployment rate below nine per cent. Inflation peaked in mid-2022. The current account deficit also narrowed to 6.2 per cent of GDP, showcasing a positive trend in external balances,” Prime Minister Davis said in his mid-year review of fiscal performance for the fiscal year 2023/24,

He told legislators that preliminary indications suggest that the domestic economy maintained its growth trajectory in the latter half of 2023, at a gentler pace, as economic conditions continued to normalize.

Prime Minister Davis said strong tourism performance was supported by increases in both air traffic and sea arrivals, reflecting continued demand for travel in the country’s key source markets.

“As consumer activity expanded, so did inflationary pressures, albeit in a more subdued manner, compared to recent experience, as measured by changes in the average Consumer Price Index. At the end of November, the Index rose two per cent as compared to the prior year – largely owing to increased health prices, as well as domestic adjustments to the rise in global commodity prices. However, transportation prices had a noteworthy decline, reflecting a moderation in the rate of increase in global oil prices compared to the previous year.”

Davis said looking ahead to 2024, the economic outlook remains favourable, with continued growth anticipated, especially in the tourism sector.

He said the government remains aware of the risks it faces as a developing small island state (SIDS), including the possibility of economic slowdowns in tourism source markets, or costly natural disasters.

Prime Minister Davis says the government is taking multiple steps to address these risks and bolster our economic resilience, including measures to build fiscal buffers, as well as exploring investments in renewable energy infrastructure.

He told legislators that during the first half of the 2023/24 fiscal year, preliminary total revenue collections are assessed at US$1.30 billion, which represented a US$43.8 million increase over the same period of the prior year.

Davis said that to date, revenue collections accounted for 39.2 per cent of the annual budget target.

He said stronger collections are expected in the second half of this fiscal year, reflecting the cyclical nature of the fiscal year.

“In addition, the revenue yield in the second half of the fiscal year will benefit from new measures such as the increase of the cruise departure tax and the new Business Licence Act.”

Prime Minister Davis said this Act introduces new fees for international businesses companies (IBCs) for the first time, adding “we have not forecasted any major uplift as IBCs by their very nature are mobile”.

He said the tax revenue collections improved by US$72.9 million, and stood at US$1.2 billion for the first six months of the fiscal year, representing 40.1 per cent of the budget target.

“This administration implemented a structural reform in the VAT regime, effective January 2022, which reduced the rate from 12 per cent to 10 per cent. Value-added tax collections accounted for 55.2 per cent of tax revenues, and totaled US$646 million at the half-year mark.”

Prime Minister Davis said this represented growth of US$47.2 million relative to the same period in the previous year, and equated to 40.6 per cent of the annual budget target. He said compared to FY2021/2022, before the VAT rate reform, the six-months VAT collections this year have increased by 18.6 per cent or $101.4 million.

“ We reduced the rate of VAT, but the strength of our growing economy, along with significant improvements to our enforcement efforts, has led to increased VAT revenues.”

The government said that excise tax during the period improved to US$15.4 million, a US$14.3 million increase compared to the previous year. At the half-year mark, excise tax surpassed the budget target by 540.9 per cent or by US$13 million, it added.

Prime Minister Davis said with the sustained improvement in the tourism sector, departure tax collections totaled US$84.8 million, and improved by US$13.3 million relative to the previous year.

“At the half-year mark, departure tax accounted for 42.5 per cent of the budget target. With introduction of the departure tax adjustments for cruise passengers, we expect a further and significant increase in this revenue component for the remaining six months of the fiscal year.

“In the non-tax revenue component, collections were mainly higher for fees and service charges as they relate to customs fees, which increased by US$5.4 million to US$27.6 million, and equated to 50.3 percent of the budget target. ”

Prime Minister Davis said that for the first six months of the year, preliminary aggregate expenditure was US$1.56 billion, which represented an increase of $24.7 million over the previous year.

He said to date, total expenditure represents 45.2 per cent of the annual budget target.

“Preliminary valuations of recurrent spending for the period made up 46.2 percent of the budget target amounting to US$1.43 billion. Recurrent spending increased by US$8.5 million year-over-year.”

He said key spending components included an increase in compensation of employees by US$18.2 million, to US$417.6 million, and representing 48.8 per cent of the budget target. He said the increased spending in this component is explained by higher employment costs because of planned promotions, and other staff and salary adjustments during the period.

The public debt interest payments increased by US$20.2 million to US$301.1 million and equated to 49.1 per cent of the budget forecast.

Spending on the use of goods and services decreased by US$23.2 million to US$251.7 million, and accounted for 40.0 percent of the annual budget target.

Prime Minister Davis said direct COVID-related spending during the period significantly eased to one million US dollars, a contraction of 78.2 per cent relative to the same period in the previous year.

He said social assistance spending, on the other hand, rose by 44.3 percent, reflecting the Government’s broader objective of providing enhanced assistance to households.

Capital expenditure for the first half of the fiscal year totaled US$134.1 million, a US$16.2 million increase over the same period in the previous year. Capital expenditure accounted for 36.8 percent of the annual budget target.

“It is expected that there will be increased levels of capital expenditure in the latter half of the year, as several important projects are currently being carried out. These projects primarily focus on repairing education facilities, improving family island airports and road infrastructure, and undertaking various other initiatives that will contribute to the growth and development of our nation,” Davis told legislators.